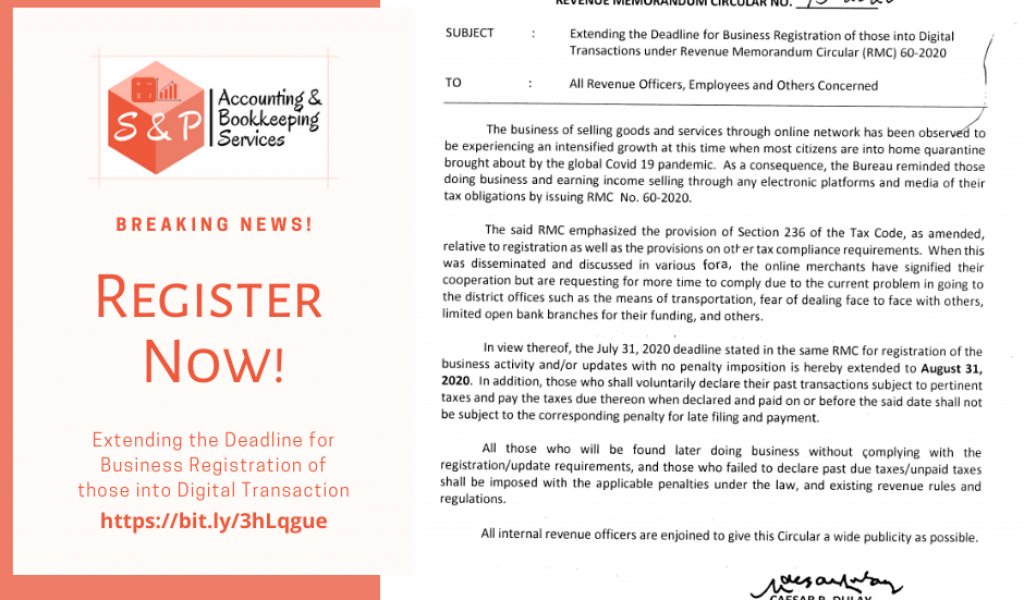

BIR extends the deadline to August 31, 2020 for online business registration.

Online sellers now have until end of August to register their business, according to the Bureau of Internal Revenue.

“All those who will be found later doing business without the registration … and those who fail to declare past due taxes shall be imposed with applicable penalties under the law, and existing revenue rules and regulations,” Dulay warned.

The initial deadline for the online business registration was July 31, Friday.

Authorities earlier said those earning less than P250,000 per annum are exempt from paying income taxes, in accordance with the Tax Reform for Acceleration and Inclusion Act also known as the Train law.

However, all online merchants, regardless of revenues, are required to register, for they run the risk of facing a fine when they fail to do so.

If you do not have time to process your papers, then that would not be a problem. All you need to do is contact us via our Facebook Page : fb.com/AccountingTarlac or call us at +63-905-973-0299 / +63-946-666-8945

Get in Touch

Contact Details

Phone Numbers

+63-905-973-0299 +63-946-666-8945

info@snpbookkeeping.com

Address

Tuscany Estate, Burot, Tarlac City, Philippines 2300